Various benefits of the scheme can be availed by employees during the time of employment or after their retirement. The Sukanya Samriddhi Yojana Calculator helps an individual to get an estimate of the investment plan under the Sukanya Samriddhi Yojana SSY scheme.

Epf Interest Rates 2022 Epfo Cuts Interest Rates From 8 5 To 8 1

Changes How to file.

. Sukanya Samriddhi Yojana Calculator. EPF Form 11 is a declaration form which has to be submitted by an employee when taking up new employment in an organization which offers EPF Scheme Employees Provident FundThis form contains basic information regarding the employee like name date of birth contact details previous employment details KYC Aadhar Bank account PAN etc details. Currently the interest rate on the deposit of EPF is 85 per annum.

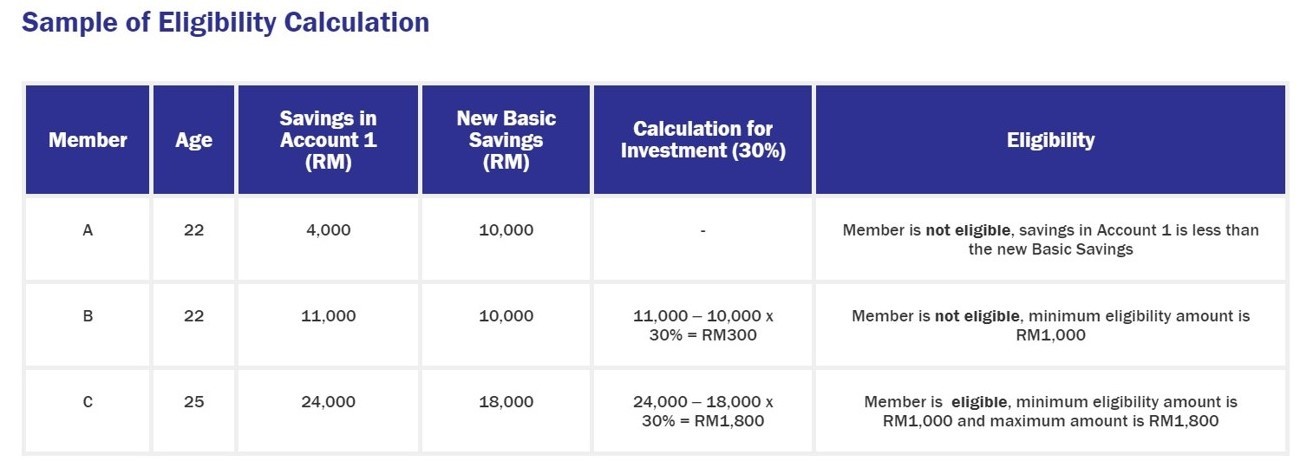

Standard Employer EPF Rate is 13 if the Salary is less than RM5000 while 12 if the Salary is more than RM5000. The calculator will use the details such as the investment made every year and the rate of interest mentioned by you to evaluate the data and give you the end result in terms of the. Yes you can open both EPF and PPF Accounts.

Income Tax Notice for Inconsistency in Salary Income and Form 26AS. So your and your employer. An individual who joined the Employees Provident Fund scheme after September 1 2014 cannot open an Employees Pension Scheme account if hisher monthly salary exceeds Rs 15000This is because the government amended the rules related to EPF and EPS schemes via a notification dated August 22 2014 which became effective from September 1 2014.

Here salary does not include your HRA conveyance allowance special allowance or any other. Although every person has their saving plans EPFO Pension Online Apply. This is the basic workings of an EPF scheme.

Income Tax for FY 2019-20 or AY 2020-21. The EPF interest rate for FY 2018-2019 is 865. As mentioned earlier interest on EPF is calculated monthly.

But through this plan they can do extra savings and which they can get only when they left their. I have modified my Basic details through UAN Login as on 080819 and twice visited to EPF regional office at Vashi in September month to the Accounts Department to authenticate my Name as per Aadhar. 3 Organisation Employees Provident Fund Organization EPFO.

But still it shows status that One request submitted directly to EPFO field office to Change name is pending for approval against UANxxxxxxxxxxxx. But this rate is revised every year. Contribution 12 of the employees basic salary towards the scheme is made by the employer and employee each.

Nowadays it has become mandatory for employers and employees to register theirs contribute to EPF. EPF can be a good investment plan as it also. The EPF Interest Rate is fixed at 81 for FY2022.

ITR for FY 2018-19 or AY 2019-20. The employer should also make an equal contribution to the EPF scheme. How to agree to income tax notice under 1431a due to variance in income and file revised return.

Basis EPF ESI 1 Acts Applicable The Employees Provident Funds And Miscellaneous Provident Act 1952. Related Reading Where does EPF invest your money. Employees State Insurance Act 1948 Extends to Whole INDIA Whole India 2 Name of Scheme Employees Provident Fund Scheme.

In the event you are looking for ERP system with an affordable HR Payroll read this HR Payroll for Malaysia. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. The employees who fall under the EPF scheme make a fixed contribution of 12 of the basic salary and the dearness allowance towards the scheme.

So the EPF interest rate applicable per month is 86512 07083. The EPFO Central Board of Trustees fixes the EPF interest rates after consulting the Ministry of Finance. Since 2020 the default.

On one hand EPF requires employees to make 12 contribution of the basic salary and dearness allowance. Until FY 2020-21 the interest income earned on contributions to EPF made by the. E-verification of Income Tax Returns and Generating EVC through Aadhaar Net Banking.

But the benefit of this scheme is added continuously under UAN. The employer also contributes an equivalent amount 833 towards EPS and 367 towards EPF in the employees accountThe employee can withdraw the accumulated corpus at the time of. Employees State Insurance Corporation ESIC 3.

On the other hand VPF is a voluntary scheme which allows the investors to electively decide the contribution amount. The EPF scheme is handled by the Employees Provident Fund Organisation. You can also check the past changes in historical EPF interest rates.

Now the deduction towards EPF has to be 12 of your basic salary as per the laws. Assume that you the employee in this case joined the job exactly on 1 st April 2018. Over the career time one shifts a job multiple times.

We are all aware that Budget 2021 The Finance Bill 2021 has introduced one of the key amendments to the EPF Act. Employees Provident Fund EPF is a retirement benefits scheme where the employee contributes 12 of his basic salary and dearness allowance every month. 25 lakh by an employee to a recognized provident fund is taxable.

As of now the EPF interest rate is 850 FY 2019-20. EPF comes under Employee Provident Fund and Miscellaneous Provisions Act1952. However do note for the purposes of EPF salary means only two things your basic and your dearness allowance DA.

EPF is an excellent saving scheme for building a sufficient retirement corpus for salaried employees. As per this amendment from 1st April 2021 onwards the interest on any contribution above Rs. If you are interested to know the calculation of the EPF contribution formula you have came to the right place.

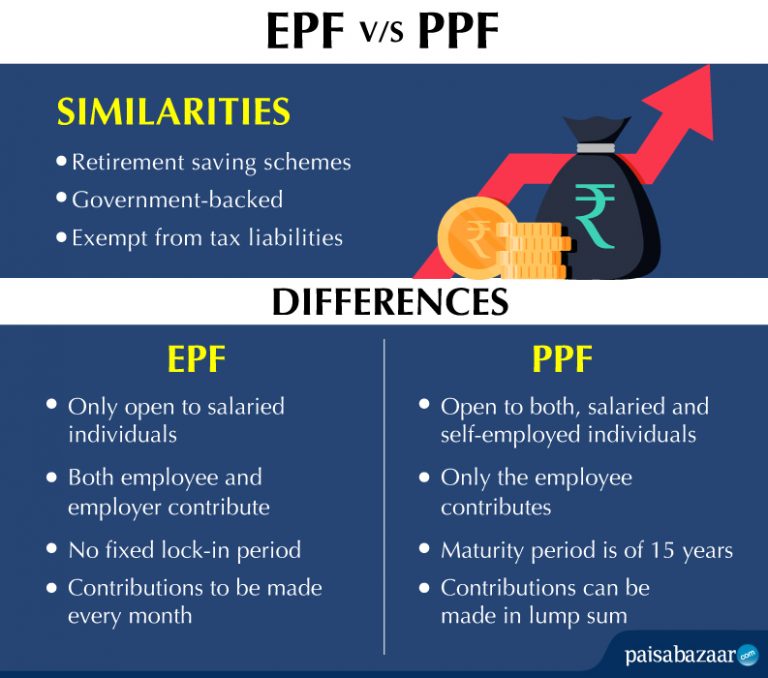

Can I have both EPF and PPF Account. VPF is an extended version of EPF. Lets use this latest EPF rate for our example.

Epf Vs Nps Which Is A Improved Retirement Saving Choice For You Post Proposed Alterations In Epf Pensions Saving For Retirement Budgeting

Budget 2020 New Tax Slabs Tax On Dividend Employer Contribution To Nps Epf And Some Mess For Nris Personal Finance Plan

Labour Ministry Notifies 8 65 Interest Rate On Epf For 2018 19 Interest Rates Growing Wealth Personal Finance

How To Update Kyc Epf Online Pf Me Aadhaar Card Pen Card Bank Account Link Kare Epf Kyc Online

Epf Vpf Historical Interest Rate Interest Rates Rate Historical

A Complete Guide On Process For Epf Withdrawal Online Claim Ebizfiling

Pin By Chin Eu On Epf Kwap Ltat Lth Pnb Ptptn Investing Periodic Table Estimate

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Epfo And Uan All Information In Hindi Youtube How To Apply Hindi Accounting

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

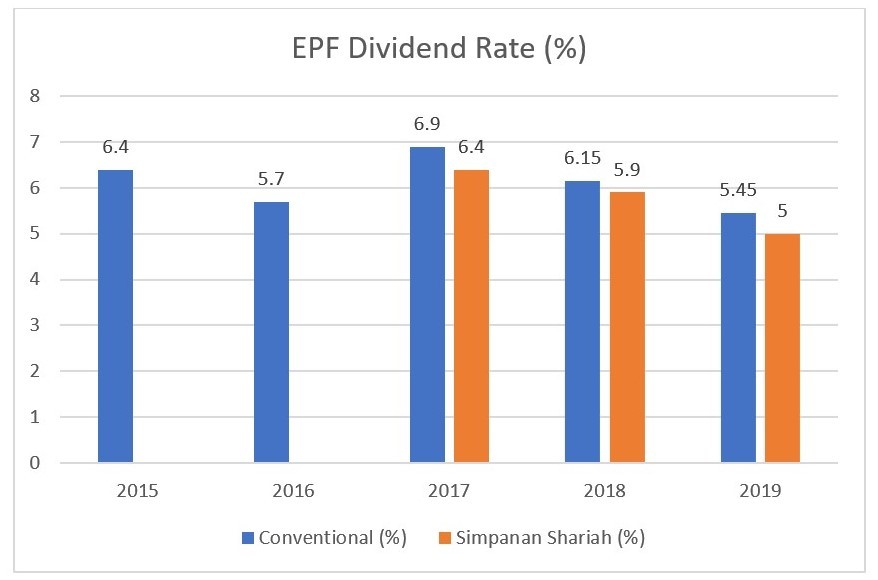

2 Statistical Summary Of Epf Return On Investment And Dividend Rate Download Table

1 Statistical Summary Of Epf Investment Asset Allocations Download Table

How To Save Rs 10 Crore For Retirement Without Taking Too Much Risk Investing Money Saving Tips Self Improvement Tips

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Epf Dividend Table 2019 Dividend Life Insurance Policy Financial Instrument

Differences Between Epf And Ppf That You Must Know About

How To Do Epf E Nomination With Beneficiary Aadhaar Photo Investment In India News Online Stock Market Investing

How Social Security Code 2019 Will Impact Employees Gratuity Protect Their Epf Dues Savings And Investment Employee Benefit Coding